Family heirlooms are more than just objects—they’re treasures that carry memories, traditions, and stories across generations. Whether it’s Grandma’s secret recipe, a vintage jewelry piece, a classic car, or a handcrafted quilt, deciding who will inherit family items can sometimes spark tension among family members. That’s why estate planning for family heirlooms is an important part of creating a thoughtful, comprehensive estate plan.

At Best Coast Estate Law, P.C., we help California families navigate emotional decisions so that cherished possessions pass to the people who will value them most, without causing conflict.

Estate Planning for Family Heirlooms

Estate planning is often focused on major financial assets like homes, retirement accounts, and investments, but family heirlooms often carry emotional significance that can exceed their monetary value. Without clear instructions, heirlooms can become points of disagreement or even legal disputes among family members.

Estate planning for family heirlooms ensures the deceased’s wishes are respected. It provides clarity for loved ones, reduces the potential for family conflict, and preserves the sentimental value of items that matter most.

Common Types of Family Heirlooms

Heirlooms can take many forms, and each type requires careful consideration:

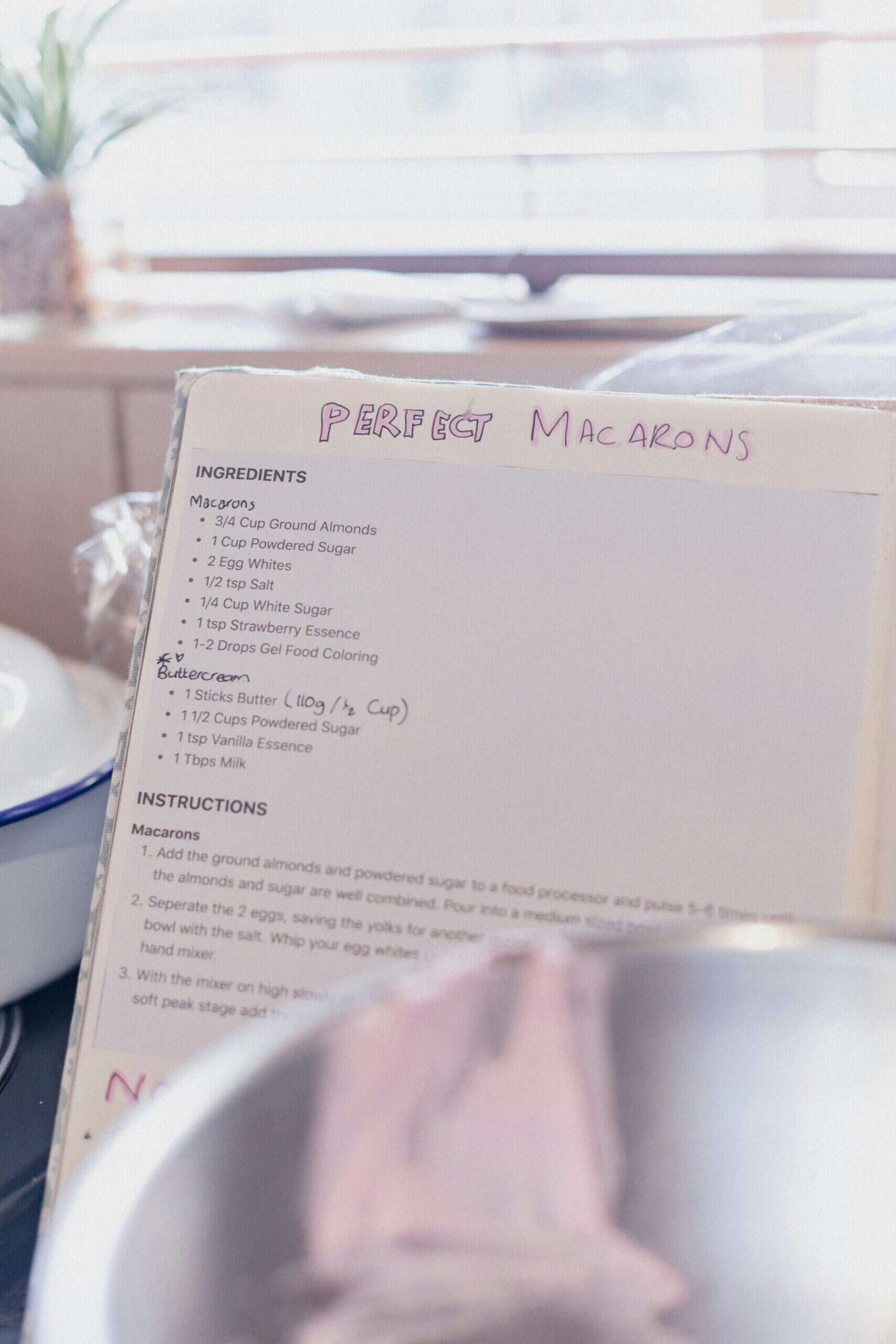

- Sentimental items: Grandma’s secret recipe, letters, family photos, or a handmade quilt.

- Jewelry and collectibles: Vintage watches, necklaces, coins, or art pieces.

- Vehicles or specialty items: Classic cars, boats, or even a family cabin.

- Digital heirlooms: Online accounts, digital photo libraries, or intellectual property.

Understanding the type of heirloom can help determine the best way to pass it on while maintaining family harmony.

Strategies for Estate Planning for Family Heirlooms

There are several strategies to make sure heirlooms are distributed according to your wishes:

Include Specific Gifts in Your Will

A simple but effective estate plan will include the heirloom in your will. Clearly describe the item and name the person who should receive it. For example: “I leave Grandma’s Sunday sauce recipe, contained in her recipe book, to my daughter, Jane Doe.” Being precise reduces ambiguity and potential conflict.

Use a Trust for Valuable or Multiple Heirlooms

If you have several heirlooms or high-value items, trusts provide structure and clarity. A trust allows you to designate who receives each item, and a trustee can ensure items are delivered according to your instructions. Trusts are legally binding documents and also avoid probate, which can speed up the transfer of heirlooms to your heirs.

Create a Family Heirloom Letter or Personal Property Memorandum

For items of emotional rather than financial value, consider writing a letter or memorandum outlining your wishes. While this document may not always be legally binding, it provides guidance for your heirs and can be referenced by your executor or trustee.

Consider Fair Market Value and Taxes

Some heirlooms, especially valuable antiques or collectibles, may have high monetary value and trigger gift taxes. Properly accounting for these in your estate plan can help avoid unexpected tax consequences for heirs. A California estate planning attorney can guide you on whether certain gifts trigger estate taxes and how to structure distributions efficiently.

Open Family Conversations and Clear Communication

Estate planning for family heirlooms isn’t just about documents—it’s also about communication. Discussing your intentions with family members can reduce misunderstandings and emotional conflicts. Sometimes, a simple conversation about who values certain heirlooms most can prevent disputes down the line.

Digital and Intangible Heirlooms

In today’s world, heirlooms aren’t just physical items. Digital assets, including family photos stored online, email accounts, and even intellectual property like songs or recipes, can be passed down as part of your estate plan to future generations. Make sure your estate planning strategy includes instructions for accessing and transferring these digital heirlooms, including account login information and rights to use intellectual property.

Avoiding Common Estate Planning Mistakes

Some common mistakes when planning for heirlooms include:

- Being vague – Simply stating “everything goes to my children” can lead to disputes. Be specific about each item.

- Ignoring sentimental value – Significant monetary value doesn’t capture what an item means to your family.

- Failing to update documents – As families grow or relationships change, update your will or trust to reflect current circumstances.

- Overlooking storage and maintenance – Valuable heirlooms may require special care or insurance, and your estate plan should account for these considerations.

The California Trust Perspective

California estate laws allow you to clearly outline your intentions for personal property, including family heirlooms, in your will or trust. The law also provides tools to avoid probate for valuable items, which can simplify the process and minimize potential family disagreements. An experienced California estate planning attorney can help ensure your heirlooms are distributed exactly as you intend, whether they are small sentimental items or high-value collectibles.

Planning Ahead Preserves Memories

Family heirlooms carry stories, memories, and traditions that go beyond their material worth. Planning for them thoughtfully in your estate planning documents ensures that Grandma’s secret recipe, a vintage necklace, or a family cabin is passed down in a way that honors your legacy and strengthens family bonds.

Best Coast Estate Law, P.C.’s estate planning lawyers help California families create estate plans that reflect both financial realities, sentimental priorities, and hit all the relevant details. By planning ahead, you can safeguard your heirlooms, minimize conflicts, and leave a lasting legacy for the generations to come.

Call us for a free consultation.